- Stochastic Modeling Explained

- Example

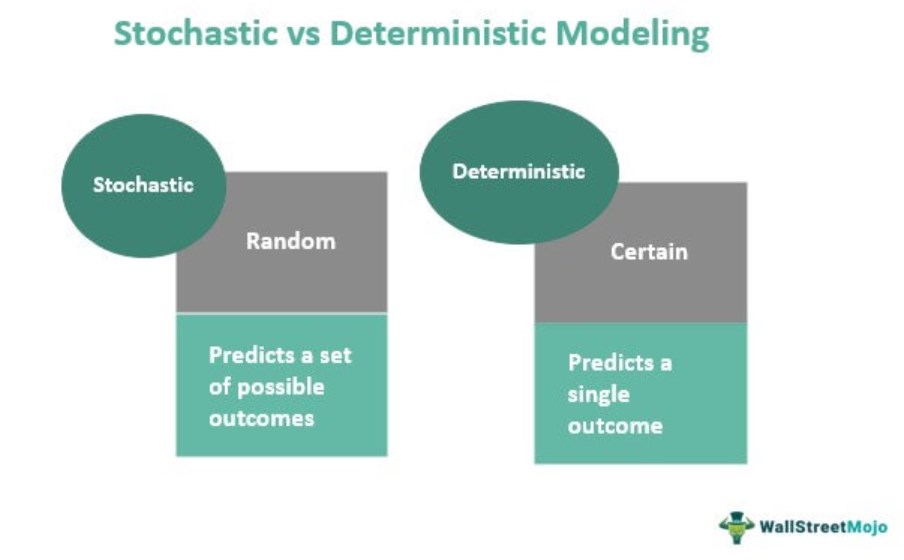

- Stochastic vs. Deterministic Modeling

- Uses of Stochastic Modeling

- Frequently Asked Questions (FAQs)

- Recommended Articles

- Stochastic modeling develops a mathematical or financial model to simulate an entire system and derives a set of possible outcomes with its probability distribution.

- The deterministic model predicting a single output exemplifies the opposite concept of the stochastic model as they do not involve any randomness or uncertainty.

- Its application is seen in various sectors like the financial market, agriculture, weather forecasting, and manufacturing.

- Examples of stochastic models are Monte Carlo Simulation, Regression Models, and Markov-Chain Models.

Stochastic Modeling Explained

The stochastic modeling definition states that the results vary with conditions or scenarios. The modeling consists of random variables and uncertainty parameters, playing a vital role. It brings the probability factor in the calculation, which determines every possible outcome. For the probability determination of each result, the inputs are given variation from time to time. Thus, it contributes to the computation of probability distributions which are mathematical functions that reflect the similarity of different outcomes.

The model stands on many criteria to ensure accuracy in probable outcomes. Therefore, the model must cover all points of uncertainty to showcase all possible results for drawing the correct probability distribution. Furthermore, every probability is related to one another within the model itself and collectively contributes to computing the randomness of the inputs. These probabilities are further used for predictions and forecasting relevant information.

The stochastic prototype provides several outcomes, and it is applied commonly in analyzing investment returns. First, it studies the market volatility based on the uncertain input and probability of various returns. Thus, stochastic modeling in finance helps investors discern the unknown outcomes that usually do not consider in the analysis. The variable is generally time-series data depicting the difference between historical data, and the final distribution result describes the inputs' randomness.

Example

One of the famous stochastic modeling examples is Monte Carlo Simulation, invented by famous Mathematicians John Von Neumann and Stanislaw Ulam during World War II to enhance decision-making in an environment filled with uncertainty. It is a computerized simulation technique used for decision-making by professionals in diverse disciplines like engineering and finance. The method creates an artificial world similar to the real-world case using numerous random samples, observing the outcome and its probabilities to derive practical solutions.

Stochastic vs. Deterministic Modeling

The prime difference between stochastic and deterministic representation is noticeable in the name itself. The word "stochastic" indicates a random probability distribution, whereas "deterministic" indicates the absence of randomness.

The following table demonstrates the significant differences between the stochastic and deterministic methods:

| Features | Stochastic Modeling | Deterministic Modeling |

|---|---|---|

| Outcomes | Produces a set of possible outcomes for a problem. | Creates a single output for a problem. |

| Input/Properties | All properties are random, or inputs are random variables leading to different outputs. | All properties are certain, or no random value is taken into account, and the model only works on defined values providing a single result. |

| Complexity in design | Stochastic models are more complex given to their prediction and forecasting inclined to use random variables and several conditions. | Deterministic modeling is less complex; it follows a set path and does not deflect due to randomness or uncertainty. |

| Example | Example of stochastic model: The Monte Carlo simulation | Example of deterministic model: Water Balance Model |

Uses of Stochastic Modeling

The application of stochastic modeling has a broad scope and importance in different fields and areas of study. Some of the prominent uses of it are as follows:

- Investment decisions: Stochastic modeling in finance is predominantly associated with investment decision-making. It is used in financial analysis to decide on investment decisions, return on investment, etc. The model provides the probable outcomes corresponding to various scenarios.

- Agriculture: The model is used in the agriculture field for effective decision-making during uncertain situations. For example, its application in farmland and irrigation management increases farmers’ profit.

- Weather forecasting: The application of stochastic approaches in substantial weather and climate prediction prototype is proven, and stochastic predictands can correct many of the inaccuracies in the other frameworks.

- Manufacturing: Stochastic replicas of a wide range of manufacturing systems are used for practical examination purposes.

- Biochemistry and Systems Biology:Stochastic kinetic methods are used to structure the dynamics of biochemical and biological networks.

Frequently Asked Questions (FAQs)

What is stochastic volatility modeling?The stochastic volatility model considers the volatility of a return on an asset. The fundamental of stochastic volatility is that asset price volatility is not constant; it varies. They are used in mathematical finance to evaluate derivative securities, such as options.

What are the differences between stochastic and deterministic models?The word stochastic implies u0022randomu0022 or u0022uncertain,u0022 whereas the word deterministic indicates u0022certain.u0022 When it comes to stochastic and deterministic frameworks, stochastic predicts a set of possible outcomes with their probability of occurrences. In contrast, the deterministic model produces only a single output from a given set of circumstances.

What is stochastic modeling?It is an example of modeling techniques using stochastic projections. Furthermore, the model accepts possible random inputs, provides the probability distribution of possible outcomes, and is mainly used for financial planning. Examples of such models are Monte Carlo Simulation and Regression Models.

Recommended Articles

This has been a guide to Stochastic Modeling & its Definition. Here we explain stochastic modeling, its application, example & finance & volatility models. You may also have a look at the following articles to learn more –

- Probability Distribution

- Queuing Theory

- A Priori Probability

![]()

Join Wallstreetmojo Youtube